by Karl Bode

Despite government programs, national broadband plans, billions in subsidies and a lot of recent hype paid to gigabit services like Google Fiber, U.S. broadband is actually getting less competitive than ever before across a huge swath of the country. Companies like AT&T and Verizon have beenbacking away from unwanted DSL networks they simply don’t want to upgrade. In some cases this involves selling these assets to smaller telcos (who take on so much debt they can’t upgrade them either), but in many markets this involves actively trying to drive customers away via either rate hikes or outright neglect.

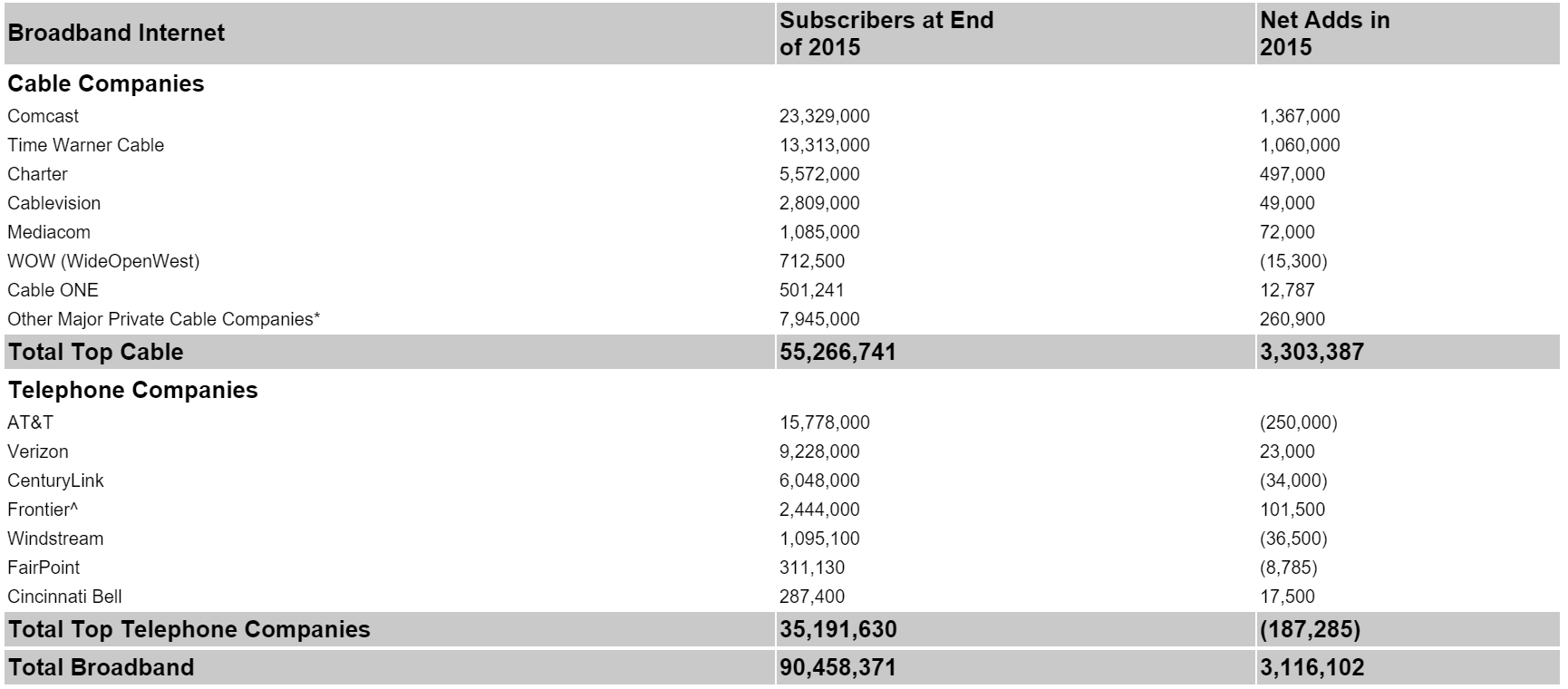

As an end result, the nation’s biggest cable companies are enjoying a larger monopoly in many markets than ever before as they hoover up those fleeing customers. According to the latest postmortem of 2015 subscriber totals, the seventeen largest broadband providers acquired 3.1 million broadband subscribers last year. But if you look at the numbers more closely, you’ll notice that nearly all of them were acquired by the cable industry:

In fact, cable added 97% of the 6.1 million subscribers added in the last two years. Phone companies, meanwhile, lost about 185,000 subscribers last year — the first time in the history of broadband that they saw a net loss. Again, that’s because many of these companies either no longer want to be in the fixed-line broadband business because they’re focusing on wireless (AT&T, Verizon) or they’re growing just for growth’s sake (Frontier, CenturyLink), acquiring neglected AT&T and Verizon assets, but saddling themselves with so much debt in the process they can’t afford necessary upgrades.

That’s great news for cable. Less fixed-line competition means they can charge higher prices, yet have less incentive to improve what’s arguably already the worst customer service in the history of industry. More importantly, the cable industry can begin experimenting with usage caps and metered billing without the pesky threat of a customer being able to leave. Of course, if you ask cable providers, they’ll be quick to assert they face greater competition than ever before — but the reality is in many markets they either face no real competition or a sagging telco trying to push 3 Mbps DSL as the pinnacle of innovation.